How to record a promissory note in accounting

What is a promissory note? Is note payable an asset? Features of a Promissory Note. It must be in writing. It contains an unconditional promise to pay.

There are only two parties to a Promissory Note , one is the maker or the payer and another. Short-Term Promissory Notes Payable A note due for repayment in one year or less is reported as a current liability in the books of the borrower's business. If a customer signs a promissory note in exchange for merchandise, the entry is recorded by debiting notes receivable and crediting sales. The maker should sign it.

Each year, in a ledger format, record the beginning value of the loan and the market interest rate. Figure out the length of the loan and the AFR. NP is a liability which records the value of promissory notes Promissory Note A promissory note refers to a financial instrument that includes a written promise from the issuer to pay a second party – the payee – a specific sum of money, either on a specific future date or whenever the payee demands payment.

This example shows how to record payment on an American Bank promissory note. You record the initial long-term debt and make payments the same way in QuickBooks as you do for short-term debt. While how you enter the initial information isn’t very different, a big difference exists between how short- and long-term debt are shown on the financial statements.

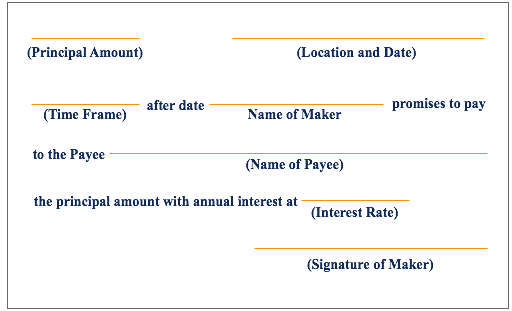

Information shown on a Note Payable. Once the underlying funds have been paid to the payee, the payee cancels the note and returns it to the maker. A promissory note differs from an IOU in that the note states the specifics of repayment, while an IOU only acknowledges that a debt exists. It can be monthly, yearly, or some other term specified in the note. Most installment loans are types of promissory notes.

When a company agrees to accept a promissory note from a customer, it must record a notes receivable in its accounting records. Recording Short-Term Notes Payable Created by a Purchase A short-term notes payable created by a purchase typically occurs when a payment to a supplier does not occur within the established time frame. Every promissory note includes the face value of the note , or the amount owe the date due and the interest rate. There is also a spot for accumulated depreciation.

You will need to create these in the Chart of Accounts. Might as well create. Go to liabilities and create a long term liability (assuming repayment is greater than year). Thus, the payee of the note should debit Accounts Receivable for the maturity value of the note and credit Notes Receivable for the note’s face value and Interest Revenue for the interest.

Remember, a promissory note is always in writing. If Ken gets a loan from a friend and doesn’t have a written agreement, it can’t possibly be a promissory note. Summary Definition.

Define Promissory Notes: A promissory note is a written contract that requires a borrower to pay back a lender an amount of money on a future date. On a balance sheet, the discount would be reported as contra liability. When the promissory note is not honore the accountant debits the accounts receivable, credits the notes receivable and credits the interest income or interest receivable.

Comments

Post a Comment