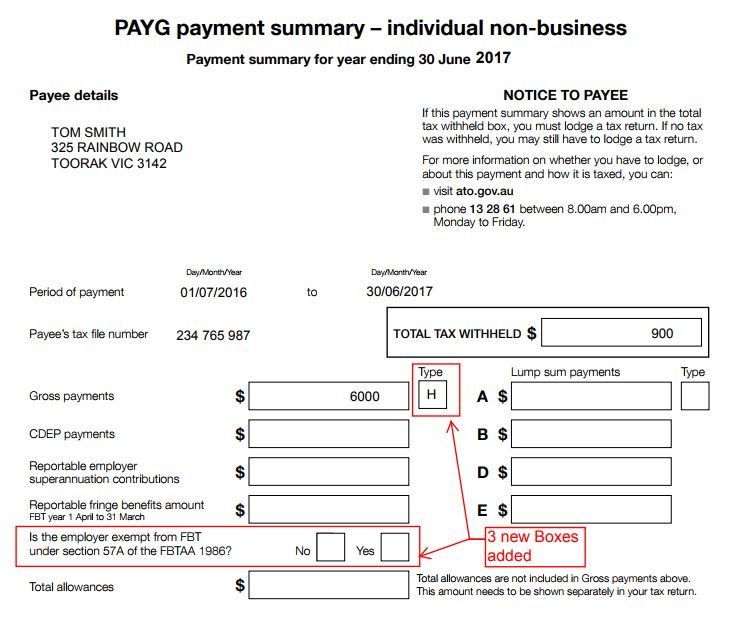

Payg payment summary gross payment type

Gross payments Include all salary , wages , bonuses and commissions you paid your payee as an employee , company director or office holder. Include the total gross amount before amounts are withheld. You will still need to provide a payment summary for any payments not reported through STP. Is this Not reportable?

During COVID-1 her hours reduced to days a week. Recently the ATO has included a new required field on payment summaries. This particular field will denote what type the payment summary is and is located next to the Gross Payments field. Below are the codes and what each particular code means. Select a payment summary field in the left panel.

You can only link a payroll category to one field. Repeat these steps for each payment summary field that applies to your business. See the information below for more detail.

All pay runs have been finalised for the year and checked to be correct. We have checked that the Payroll Summary is correct. If no tax was withhel you may still have to lodge a tax return.

For more information about this payment summary or. Once a payment to an employee has been generated via a dividen through the pay employee wages function, or via an ad-hoc payment , the amounts being reported on the payment summaries can be adjusted in the cashbook payment entry. The type of payment summary that is required depends on whether the employer is creating an original ETP payment or is amending an ETP payment that has already been reported to the ATO. PAYG payment summaries.

Place an ‘X’ in the box if the information on the payment summary relates to payments of a non‑superannuation pension or annuity. Payment summary for year ending June NOTICE TO PAYEE. If this payment summary shows an amount in the total tax withheld box, you must lodge a tax return. If you find a mistake after giving the payment summary to the payee or us, we recommend you complete a new payment summary , marking the amending a payment summary box as shown.

Sally’s termination will not meet the definition of a genuine redundancy. There is no requirement to fill out an ETP form for Sally. At the end of each financial year, you need to give each of your payees (i.e. your employees and anyone else you’ve withheld payment from) a payment summary. You must also provide an annual report to the ATO. Lump sum payments Type Gross Payments $ A $ CDEP Payments $ B $ Reportable fringe benefits amount.

FBT year April to March $ D $ Reportable Employer. Superannuation Contributions $ E $ Total Allowances $ Total allowances are not included in Gross payments above. This amount needs to be shown separately in your tax return.

Hi, this is not an ETPayment. REPORT: Update Records Check Report: UPDRECS. Any allowance type defined in the below table to be reported as part of gross payments, is to be classified as Default.

Payment Summary (Part 1) Including Holiday Fund and Loans: PSUMHOL.

Comments

Post a Comment