Spouse super contribution 2019

A contribution to the super fund of your spouse may eligible for a tax offset, if the qualifying requirements can be met. To be eligible for the maximum tax offset, which works out to be $54 you need to contribute a minimum of $0and your partner’s annual income needs to be $30or less. While you are able to contribute more than $00 there will be no spouse contribution tax offset over this amount.

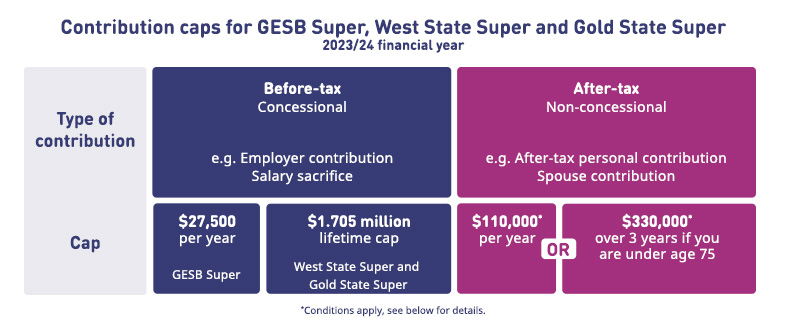

The amount you can claim depends on your spouse’s annual income: $5for spouse income of $3000. The non-concessional contributions (NCC) cap. Spouse contributions will count towards your spouse ’s NCC cap, and penalties may apply if they exceed it.

The rules that relate to the NCC cap are complex. You can find out more about them at the ATO website. If your spouse receives $ 30or less in the total of assessable income, reportable fringe benefits and employer super contributions, then you can access the maximum tax offset of $54 provided an after-tax contribution of at least $0is made. Your spouse was under years old when the contributions were made. Super co-contribution.

The offset gradually reduces for income above $30p. Contribution splitting allows you to split your concessional (before-tax) contributions from your accumulation super account with your spouse. Concessional contributions include employer and salary sacrifice contributions. They must also be eligible to receive spouse contributions. Another way to build on your joint retirement savings is to split your financial year’s pre-tax contributions across yours and your spouse ’s super funds.

Splitting super contributions. This includes the super guarantee contributions your employer is required to pay, and any additional contributions made through salary sacrifice. NGS SUPER – MAKE SPOUSE CONTRIBUTIONS WORK FOR YOU Scenario 1: A contribution for a non-working spouse If Dave contributes $0after tax into his spouse’s super account, he is eligible to receive a $5tax offset.

How spouse contributions and superannuation splitting works Spouse Contributions. After July each year, your spouse (Oracle employee) can apply to the Trustee to split some super contributions made during the previous financial year. A spouse contribution is an after-tax (voluntary) contribution made to your spouse’s super account. By making a contribution to your spouse’s super, not only are you helping them – if your partner earns less than $40a year you could be eligible for a tax offset (up to $540).

I can salary-sacrifice via my employer and make concessional-contributions to her super account. Where did you hear that? The ATO calculates if you are eligible for a co- contribution payment and pays the amount directly into your super account.

Make a spouse contribution tax offset. One of the easiest ways to boost your spouse ’s retirement savings is to make a non-concessional (after-tax) contribution directly into your spouse ’s super account. Is it possible to make it up now and get the $5offset from my tax return? You should do the transfers at least a week (perhaps more) before June to make sure it gets in in time.

How do spouse contributions work? Non-concessional contributions are contributions you or your spouse make to your super from your after-tax income. They are also referred to as personal or after-tax voluntary contributions. To receive the maximum offset of $5per financial year, your spouse would need to be earning less than $30per annum, and you would need to make a $0contribution to their super. What is the spouse contribution tax offset?

As at July of the financial year in which the contribution is made. If you intend to claim a tax deduction you must also submit a ‘ Notice of intent to claim or vary a deduction for personal super contributions’ form, which is available on our website. You must submit the form within certain timeframes.

Comments

Post a Comment