Adding a name to a property title qld

Titles and property. Learn about titles and property in Queensland. I want to add my name on to it. From reading a little on the net about this, I think I can submit forms and a statutory declaration to get this done and not pay stamp duty.

There is no mortgage on the. You can apply to add your wife’s name to the property title with your current lender (s). Alternatively, you can refinance the mortgage to a new lender and add your partner on the title. In most states, you don’t pay stamp duty when adding a partner to your title (conditions apply).

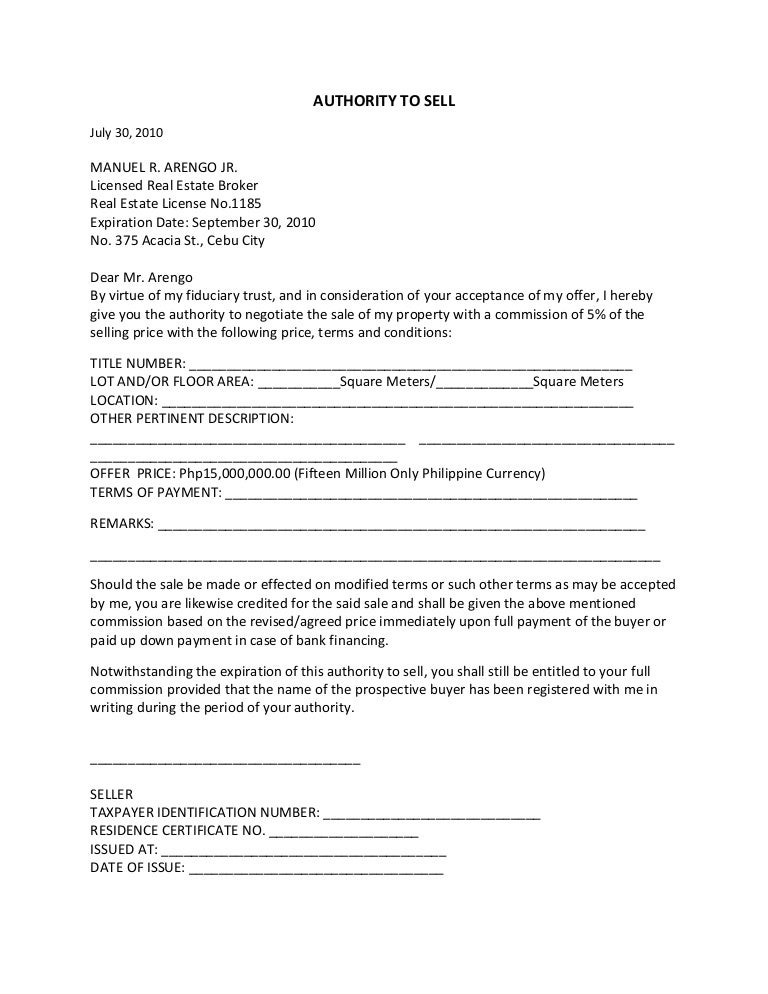

Any encumbrances on the title (e.g. mortgages) will have to agree. Some of these encumbrances will simply need a formal consent, some may have to be released and re-registered. Transfer duty will be payable on the transaction, calculated on the the amount paid by the person to transfer the property. This article describes the process and explains how to proceed.

You can transfer a property into joint names by way of a gift at any stage, particularly if the property is mortgage free. The transfer into joint names will be in consideration of your love and affection for your new wife and will represent a “lifetime gift”. However what I would like to know is that if Mum puts my name on the deeds will I be liable to pay the rates? Inherited house - changing title deeds —. Adding partners name to my house deeds —. Transfer ownership of your property You must tell HM Land Registry when you change the registered owner of your property , for example if you’re transferring it into another person’s name , or if you.

Property sales maps and reports Find recent sales data, property boundaries, street locations and titles information by purchasing a Queensland Property Sales SmartMap or a Queensland Property Unit Sales Package. When lodging documents, make sure you include a covering letter with your name, address and details of what you have lodged. The beneficiaries may have the property transferred into their names , or into the names of representatives using form APand AS1. If the owners bought the property using a mortgage, the permission of the mortgage lender will usually be necessary to be obtained in order to remove the name of one of the owners.

At the moment our house is only in my name but when she becomes I would like to add her name to the deeds. You owe gift tax only if the amount you gift exceeds $11. The person you add owes no gift tax, but she shares joint property tax liability. Where the change is not to the title but only adding a name onto the mortgage loan to satisfy the bank, there is no CGT implications. Only about of titles in Queensland still have a paper CT in existence.

The first CMS identifies the scheme land (scheme land comprises all lots and the common property for the scheme) and may also include land other than the land in the accompanying plan of subdivision. Your Conveyancing Lawyer will need to obtain a copy of the property title. If the property is registered then they can search the Land Registry for this. Once your Conveyancing Lawyer is satisfied the title is in order, they will then prepare a Transfer Deed to transfer the property from sole name to joint names.

Search by Owner Name – search using an exact company name or surname. This will require correctly completing and lodging the relevant forms along with supporting evidence, and paying the lodgement fee. RESPONSE: Dear Lorna Sterling, Provided everything is in order with title and ownership, its just a matter of filling in a transfer form with relevant information such as names of persons to be added. The accompanying fees are minimal, but you will be required to pay transfer tax which usually is 7.

Comments

Post a Comment